29 November 2018

Article by Ingo Schweder, Founder & CEO of GOCO Hospitality, and Managing Director of Horwath HTL Health & Wellness. Originally published in HOTELS magazine.

Has the hotel industry reached ‘peak yoga’ or is there still more to come? The rise of wellness in the hospitality industry over the past couple of years has been undeniable. Every major hotel brand has tried introducing essential oil aroma diffusers, provided healthy breakfast menus and brought in visiting practitioners to run workshops on mindfulness or vegetarian cooking. All of these are nice to have and sound great in the marketing, but what really is the ROI of investing in wellness?

MODERN HEALTH DYNAMICS STIMULATING WELLNESS DEMAND

Most developed economies, and now many developing ones too, are faced with ageing populations. Science is extending our lifespans, but our healthy life expectancy has not lengthened by the same amount. Obesity and chronic diseases such as diabetes, heart disease and other cardiovascular diseases are claiming more and more victims. Our mental state is also suffering. Hectic work schedules, a non-existent work-life balance, smartphone addictions and unstable personal relationships are leaving us all exhausted, stressed and frustrated.

SEE ALSO: Industry Report: Wellness Themed vs Wellness Hospitality

We can’t keep running the car at full throttle and only bring it in to the garage when it clunks out at the side of the road. It needs to be driven at a sensible speed, looked after and brought in for regular servicing and an oil change. Is it any surprise then that increasing numbers of people are turning to a holistic and preventative approach to their health and wellbeing?

The world’s wellness economy was estimated in 2017 by the Global Wellness Institute as worth US$3.7 trillion. The wellness tourism segment of this was valued at US$536 billion, and noted to have grown at a CAGR of 7% between 2013 and 2015. This is twice the growth rate of the overall tourism sector. Wellness tourism is currently predicted to reach US$808 billion in 2020, representing a CAGR of 23% between 2010 and 2020. What’s more, the wellness economy has shown itself to be incredibly resilient during economic downturns. During the 2008/2009 economic crisis, it doubled from $106 billion to $243 billion in global revenue. Naturally, when the economy is suffering and people are stressed, they re-evaluate their priorities and start focusing more on their health and mental state.

THE WELLNESS TOURIST

While it is hard to identify a “typical” wellness tourist, as so much variety exists, in general, they tend to be around 35-65 years old, better educated and have a higher disposable income. Therefore, it has been stated by the Global Wellness Institute that the average international primary wellness tourist spends around 61% more than the average international tourist.

What is important to understand is that a wellness resort is fundamentally different to a standard leisure resort in a number of ways. Firstly, in a wellness resort guests generally pay for programme packages rather than rooms. Should two guests come together, that’s twice the revenue, even if they share the room.

Wellness guests also stay longer than regular tourists. Programmes typically last three days at a minimum – with most being around five, seven or 10 days long. In addition to staying longer, the wellness tourist spends much more of their time within the resort participating in activities, giving greater opportunities for maximising revenues. With the purchase of complete packages, F&B revenues, for example, are guaranteed. A wellness tourist will typically participate in one to three treatments per day, plus consultations. As such, a wellness resort will see around 35% of their revenue come from spa and wellness activities, although this can be as high as 50%, much higher than hoteliers are used to with a standard resort. They will also eat most of their meals in the resort.

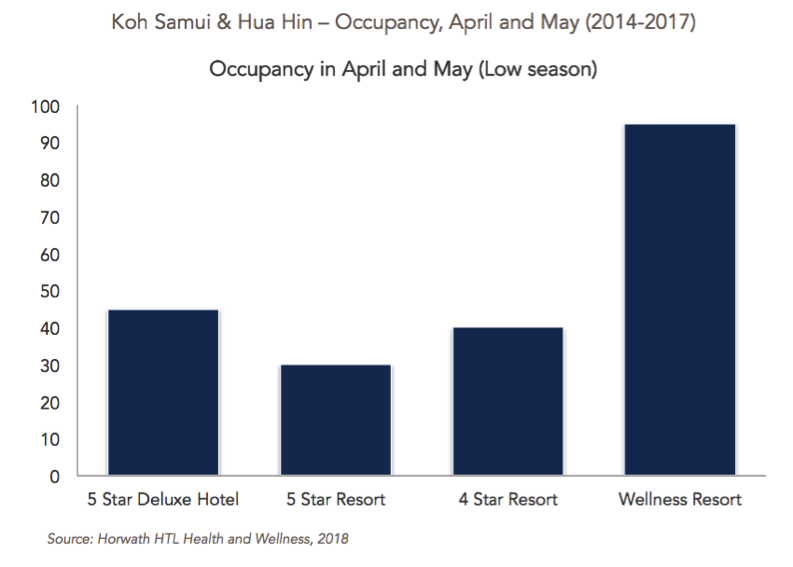

Seasonality: the bane of many a resort. Wellness resorts, on the other hand, provide a much more stable stream of guests. Wellness tourists travel for a distinct purpose. They are focused on their programmes, and so the time of the year is less relevant to them. A study comparing occupancy levels of luxury resorts and wellness resorts in Thailand found wellness resorts to have significantly higher low-season occupancy levels. Wellness resorts make their real money not in the high season, when everyone, including them, are at full occupancy, but in the shoulder and off season when the other resorts are either closed or nearly empty and the wellness resort is still running at a very comfortable level. As a destination, Kerala in India actually now has its highest occupancies during the wet monsoon season as it has managed to position itself as an Ayurvedic wellness destination.

Location is also somewhat less relevant to the wellness tourist, as it is the programme that is their primary driver of interest. In terms of marketing, wellness resorts have a much higher average percentage of repeat guests (roughly 30-55%), as once a guest decides they like a particular wellness programme, they often return year in year out. This means a lower marketing effort is needed once a wellness resort builds up a loyal following.

SEE ALSO: Management Contract MOUs Explained

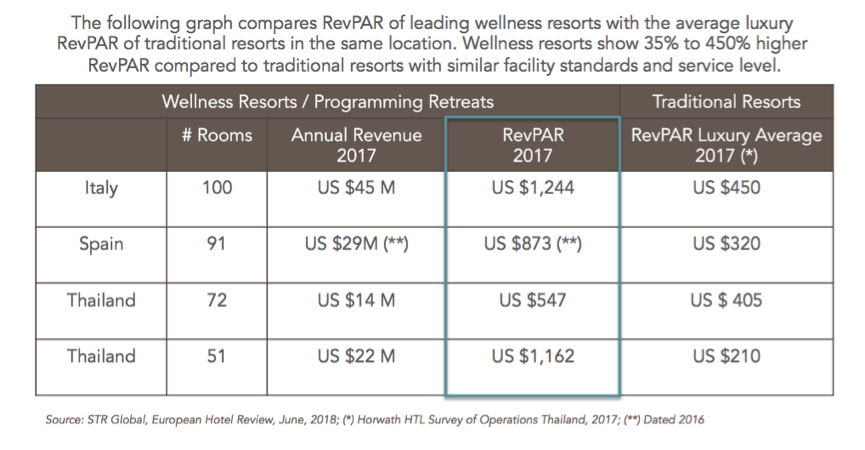

How does this all look in terms of RevPAR? Another study comparing wellness resorts in Italy, Spain and Thailand with the comparable average for luxury hotels in the same locations found a 35%-450% higher RevPAR for wellness resorts.

COST STRUCTURE

From the cost side, a wellness resort will have a somewhat similar structure to a five-star luxury resort. Construction and M&E costs generally work out to around 60-65% of development costs, while MEP and FF&E costs are approximately 12%, somewhat higher than for a regular resort, although the MEP costs will vary significantly depending on the extent of investment in heat and water facilities.

In terms of operations, wellness resorts require a pre-opening period of around 12-18 months. In addition, wellness resorts, due to the significant personalisation of a wellness stay and the increased amount of time guests spend on-site, the employee-to-guest ratio is likely to be on par with, if not higher than, a five-star boutique resort. There is also the need to hire specialist medical and wellness professionals, which can raise salary costs.

WELLNESS REAL ESTATE

With branded residences all the rage in the hospitality industry, it is worth noting that the wellness real estate sector is expected to be worth US$180 billion by 2020, with 6% average annual growth. Residences at the Serenbe wellness community in Atlanta sell for a price premium of 37-55%, and residences in London’s BedZED bring in 12-22% premiums above comparable local properties. Adding residential wellness real estate to a wellness resort development offers an attractive method of ensuring a good overall ROI.

WELLNESS HOSPITALITY: A GROWING TREND

The rising interest in wellness is not going away. People are becoming more knowledgeable about their health and realising that prevention is much better than the cure. There is also a growing disillusionment with the ability of traditional healthcare systems to support disease prevention rather than just curing health issues when they arise. The wellness travel sector will play an important part in meeting this growing need, and represents, for various reasons outlined above, an attractive investment proposition.